Case study: Salesforce

How Vertex streamlined credit and supplier risk scoring for a global food and beverage leader

Automating Financial Risk with a Centralized Salesforce Platform

Case Study at a Glance

Client

- Global food and beverage company with a vast customer base and over 40,000 direct and indirect suppliers

The Problem

- Fragmented risk evaluation processes across A/R and procurement teams

- Manual assessments of customer credit and supplier reliability led to inefficiencies and limited visibility

The Solution

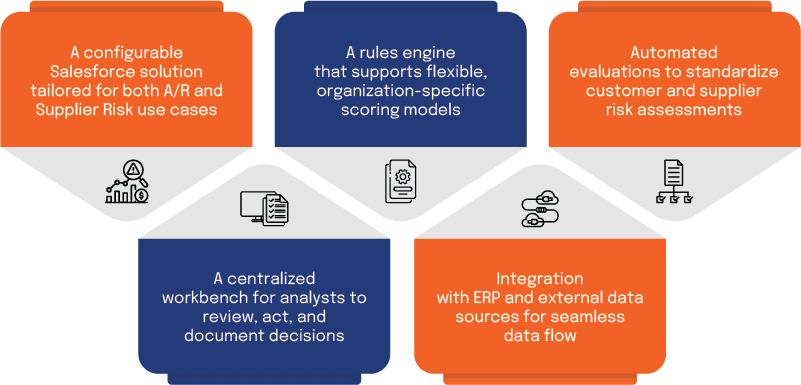

- A configurable Salesforce platform to automate financial risk scoring

- Integrated with internal (SAP) and external (Experian, D&B) data sources

- Custom rules engine and analyst workbench for scalable credit and supplier risk management

The Result

- All customers and major suppliers evaluated annually

- Dynamic credit limits auto-synced to SAP to reduce A/R exposure

- Supplier risk dashboards embedded across procurement workflows

- Improved compliance, reduced manual effort, and increased confidence in financial operations

Client Overview

A global food and beverage enterprise with one of the largest supply chains in the industry. The organization manages a vast customer base with long payment terms and works with over 40,000 direct and indirect suppliers worldwide

The Challenge

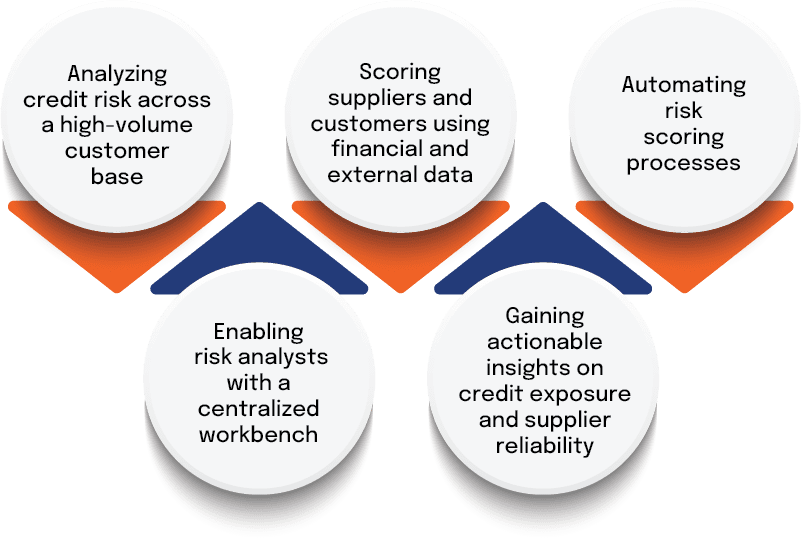

- The Accounts Receivable and Global Supply Chain teams needed a unified

digital platform to manage financial risk at scale. - Their key objectives included:

Business Impact

- Vertex delivered a Salesforce-based solution that empowered both A/R and Supplier Risk teams to make faster, data-driven decisions.

- All customers are now scored annually, with dynamic credit limit adjustments

- Credit limits are automatically pushed to SAP to reduce collection risk

- All major suppliers are evaluated annually for risk to strengthen supply chain confidence

- Risk ratings are visible across procurement teams via a centralized dashboard

- Manual assessments reduced; process now fully auditable and compliant

What We Delivered

Technical Highlights

- Integrated with internal systems (SAP) and external sources (Experian, D&B)

- Used Salesforce screen flows to simplify and standardize scoring workflows

- Enabled data encryption at rest using Salesforce Shield for financial data security

- Established a Center of Excellence (CoE) for governance, rollout, and adoption